DCF (Discounted Cash Flow) Model is used to estimate intrinsic value of the company based on Future Cash Flows (FCF).

In DCF Model, FCFs are calculated based on a cash flow Growth Rate (GR) and then based on a Discount Rate (DR),

discounted to its current value at the Discount Rate.

All of the discounted FCFs are added together to get the current Intrinsic Value (IV) of the company.

IV of the company can be divided by number of shares to get intrinsic value of each share.

For Growth Rate (GR) we recommend to use 5 or 10 year Average Annual Growth Rate (AAGR).

AAGR can handle majority of cases including negative GR where average results in a positive number.

Simplified explanation of Discount Rate (DR) is an expected rate of return on your investment.

Assume you deposited $100 to you savings account that yields 5% a year.

A year from now you will have $105 on your account.

Meaning $100 represents today's Present Value of your Future Cash Flow of $105 a year from now.

Similarly a future cash flow of $100 a year from now would translate to a Present Value of $95.

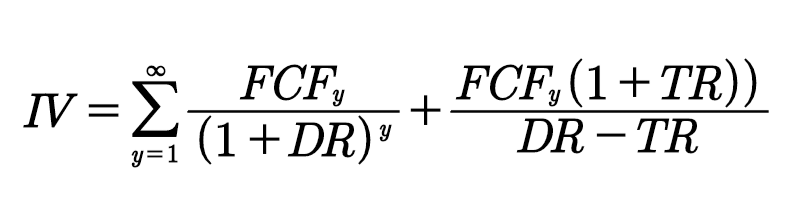

Formula representing Intrinsic Value (IV) calculated based on DCF Model:

The above formula consist of 2 parts:

Sum of Present Values for 5 or 10 years of FCFs and Terminal (Perpetual) Value.

Don't get intimidated by this formula, we will explain each parameter in more details.

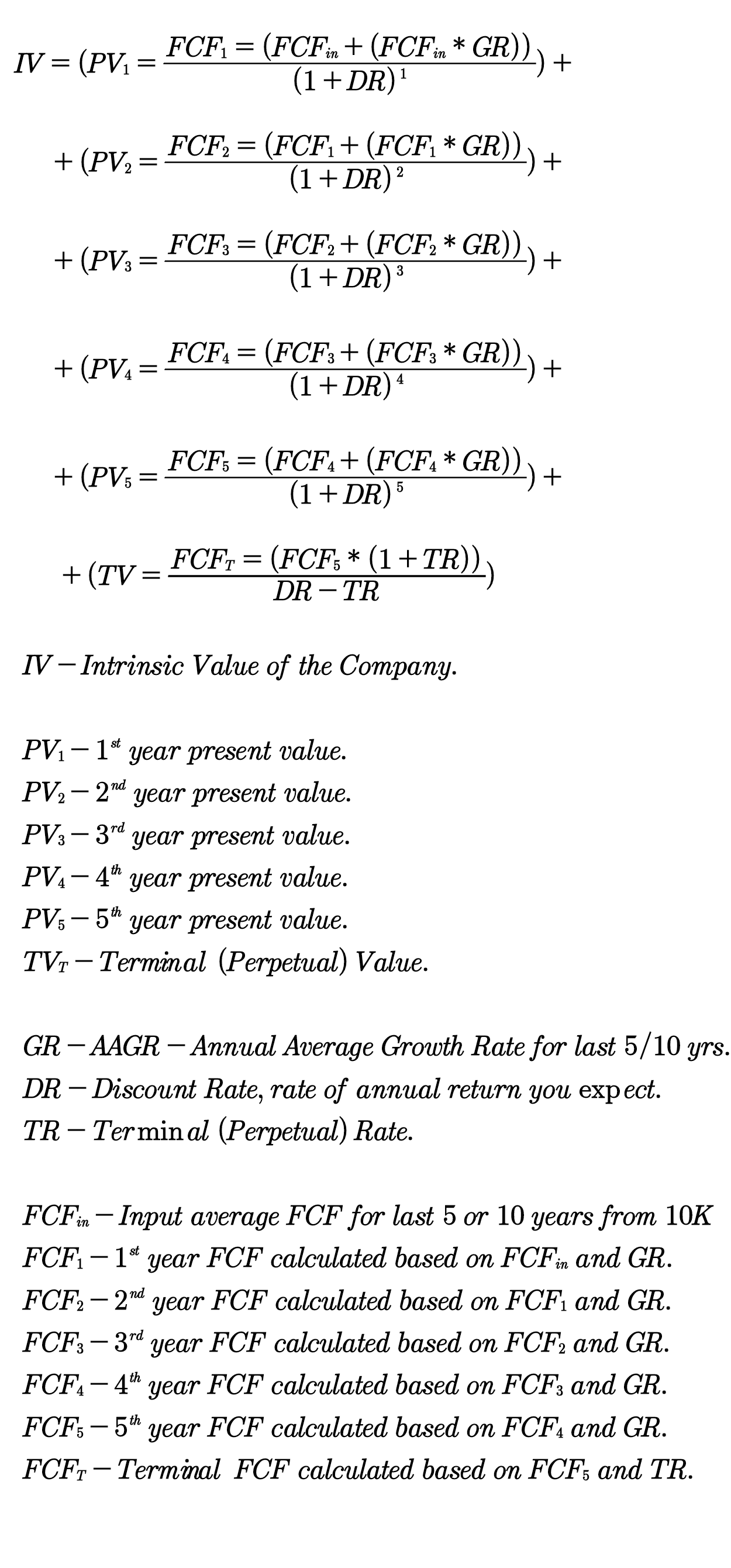

Formula below illustrates calculation of IV based on 5 years FCFs in more details.

You can see that FCF(1) for the first future year is calculated using FCF(in) - average of FCFs for the last 5 years and Average Annual Growth Rate (GR). Next FCF(1) is discounted by Discount Rate (DR) to get Present Value for the first future year PV(1). Same calculation is done for FCF(2), FCF(3), FCF(4) and FCF(5).

Terminal (Perpetual) Value (TV) represents value of the company with assumption that it will generate growth forever (perpetually). The rate used in calculation of Terminal Value is called Terminal Rate (TR) and usually TR is equal to average long term inflation rate, since even best companies usually do not perform better than inflation rate considering extremely long time horizon.

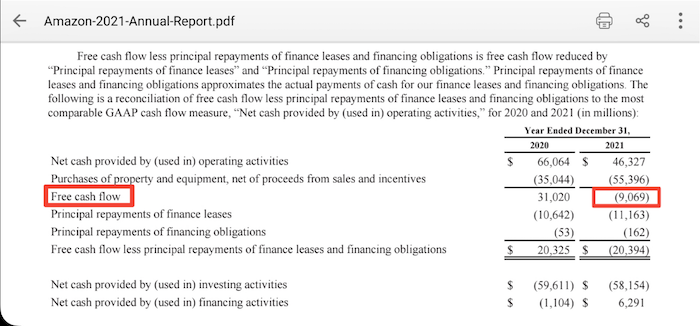

Free Cash Flow can be found on company's annual report - form 10-K.

In case of negative FCF (Free Cash Flow), you need to calculate average cash flow using annual FCFs for the duration you chose, 5 or 10 years.

AMZN example:

Amazon has negative FCF since March 2021.

Amazon Annual FCFs (in Millions $) for the last 10 years:

2022 -11,600.00

2021 -9,069.00

2020 31,020.00

2019 25,825.00

2018 19,400.00

2017 8,307.00

2016 10,466.00

2015 7,450.00

2014 1,949.00

2013 2,031.00

2012 395.00

AMZN 5 year average FCF is $11,115,200,000

and 10 year average FCF is $8,577,900,000

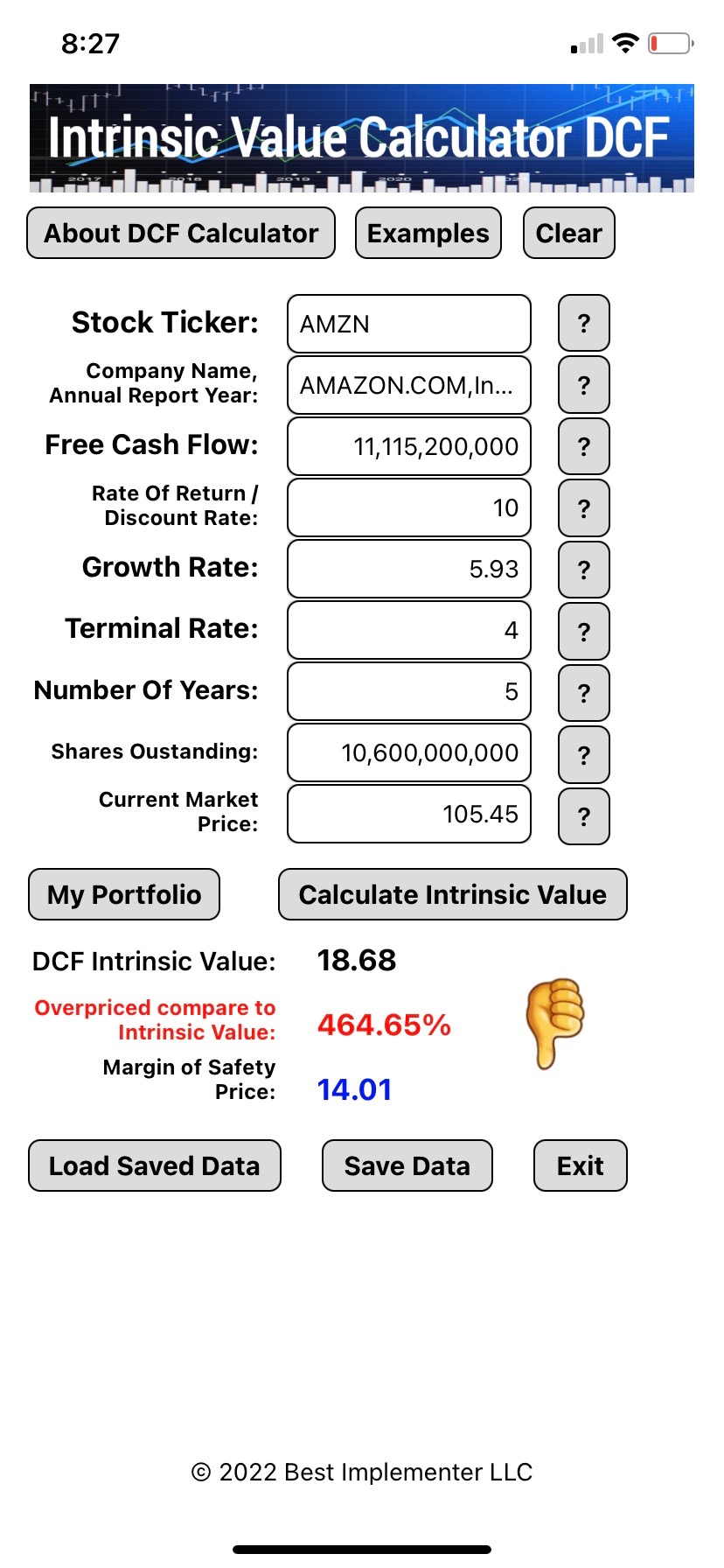

With:

Discount Rate = 10%

Growth Rate = 5.93% - AAGR for last 5 years

Terminal Rate = 5%

Shares Outstanding = 10,600,000,000

10 Year DCF Intrinsic Value will be $27.23

5 Year DCF Intrinsic Value will be $18.68

Check this Amazon Example:

Intrinsic Value Calculator DCF is available on AppStore:

Privacy policy:

No personal user data is accessed, collected or shared by this application.