Finance Video Gallery

Warren Buffet Intrinsic Value Calculator

© 2019 Best Implementer LLC. All rights reserved.

Privacy Policy:

"Intrinsic Value Calculator OE" application does not access, collect, use, share any personal and sensitive user data.

"Intrinsic Value Calculator DCF" application does not access, collect, use, share any personal and sensitive user data.

"Intrinsic Value Calculator EPS" application does not access, collect, use, share any personal and sensitive user data.

Developer: DIY Implementer

Company Name: Best Implementer LLC

If you have any questions about our Pravacy Policy, you can reach us at This email address is being protected from spambots. You need JavaScript enabled to view it.

© Best Implementer LLC.

Intrinsic Value EPS or otherwise know as Benjamin Graham's formula.

This formula was invented by professor at Columbia University and value invstor Benjamin Graham - referred to as the "father of Value Investing".

Benjamin Graham presented this formula to value investors in his book: "The Intelligent Investor", that was re-published in 1973 edition.

In Benjamin Graham's words: "Our study of the various methods has led us to suggest a foreshortened and quite simple formula for the evaluation of growth stocks, which is intended to produce figures fairly close to those resulting from the more refined mathematical calculations."

The formula as described by Graham originally in the 1962 edition of "Security Analysis", and then again in the 1973 edition of "The Intelligent Investor" :

IV = EPS x (8.5 + 2g)

IV = Intrinsic Value

= trailing twelve months earnings per share

= P/E base for a no-growth company

= reasonably expected 7 to 10 year growth rate.

Revised formula:

Graham later revised his formula based on the belief that the greatest contributing factor to stock values (and prices) over the past decade had been interest rates.

In 1974, he restated it as follows:

The Graham formula proposes to calculate a company’s intrinsic value as:

= the value expected from the growth formulas over the next 7 to 10 years

= the company’s last 12-month earnings per share

= P/E base for a no-growth company

= reasonably expected 7 to 10 Year Growth Rate of EPS

= the average yield of AAA corporate bonds in 1962

(Graham did not specify the duration of the bonds,

though it has been asserted that he used 20 year AAA bonds as his benchmark for this variable)

= the current yield on AAA corporate bonds.

Intrinsic Value Calculator EPS is available on AppStore:

Intrinsic Value Calculator EPS

Privacy policy:

No personal user data is accessed, collected or shared by this application.

Let us start with the disclaimer:

We strongly believe in the US Economy despite overblown debt and high inflation.

Our mission is to help people not to lose money in Overvalued Stock Market Bubble.

We want to show how to preserve savings/investments and benefit from the upcoming Recession by using Value Investing strategy.

The Statistical data of past and present US economic conditions confirms upcoming Recession.

Stock Market is based on "Cyclicity". Like light waves have ups and downs, stock market has booms and recessions.

We will list few facts based on importance and relevance to our Economy, indicating upcoming Recession.

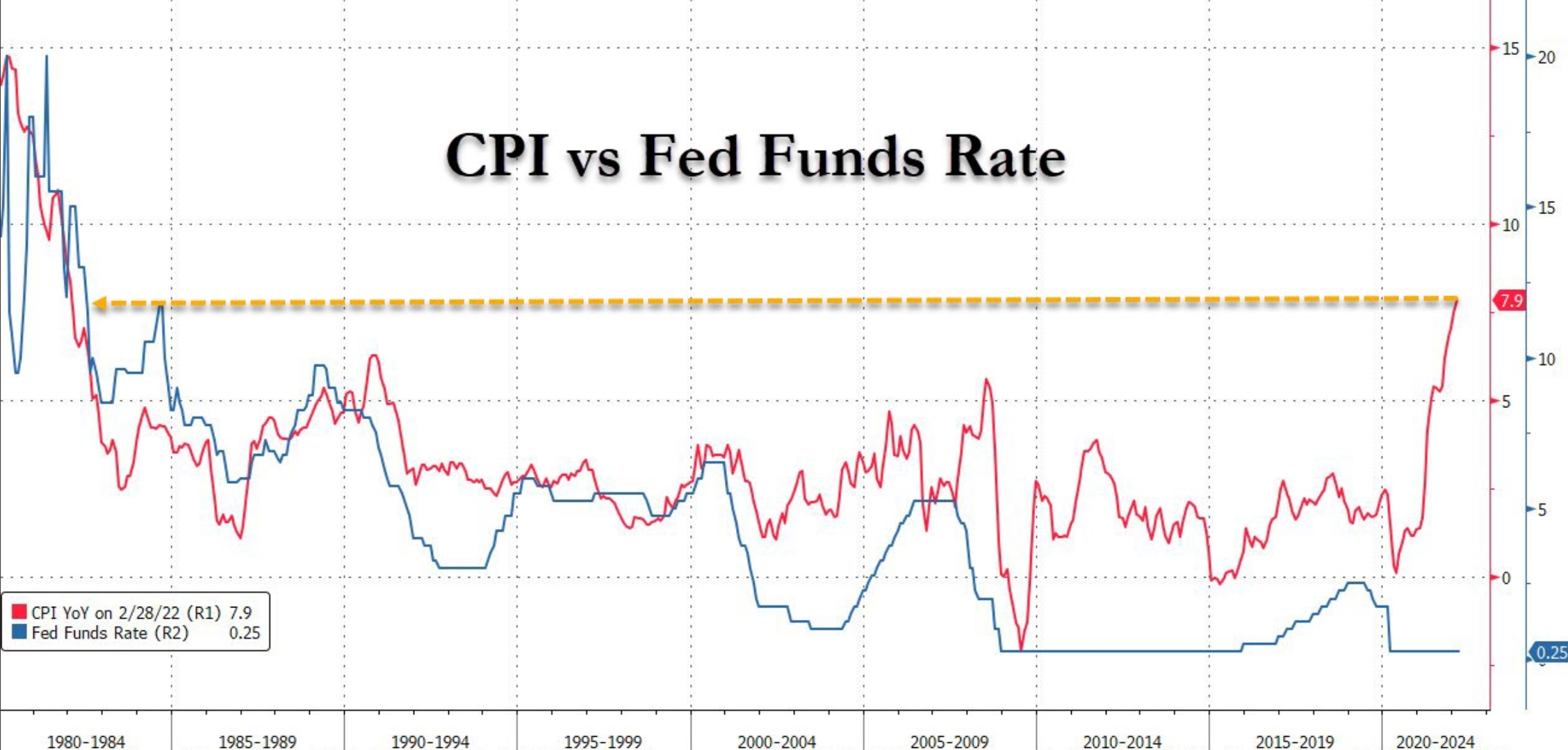

#1. First and most important indicator of a upcoming RECESSION is

U.S. Federal Reserve raising RATES

FED is raising rates to "fight" INFLATION.

Inflation was created by the FED printing TRILLIONS in QE (QuantitativeEasing) and keeping Interest Rates low.

FED is refusing to acknowledge the fact that the only reason for High Inflation is inadequate response to pandemic.

In 2021 FED keeps calling Inflation "TRANSITORY" to justify continuing printing TRILLIONS in QE and keeping RATES low.

FED keeps blaming pandemic caused supply/demand issues for causing High Inflation.

THIS IS A DECEITFUL LIE!

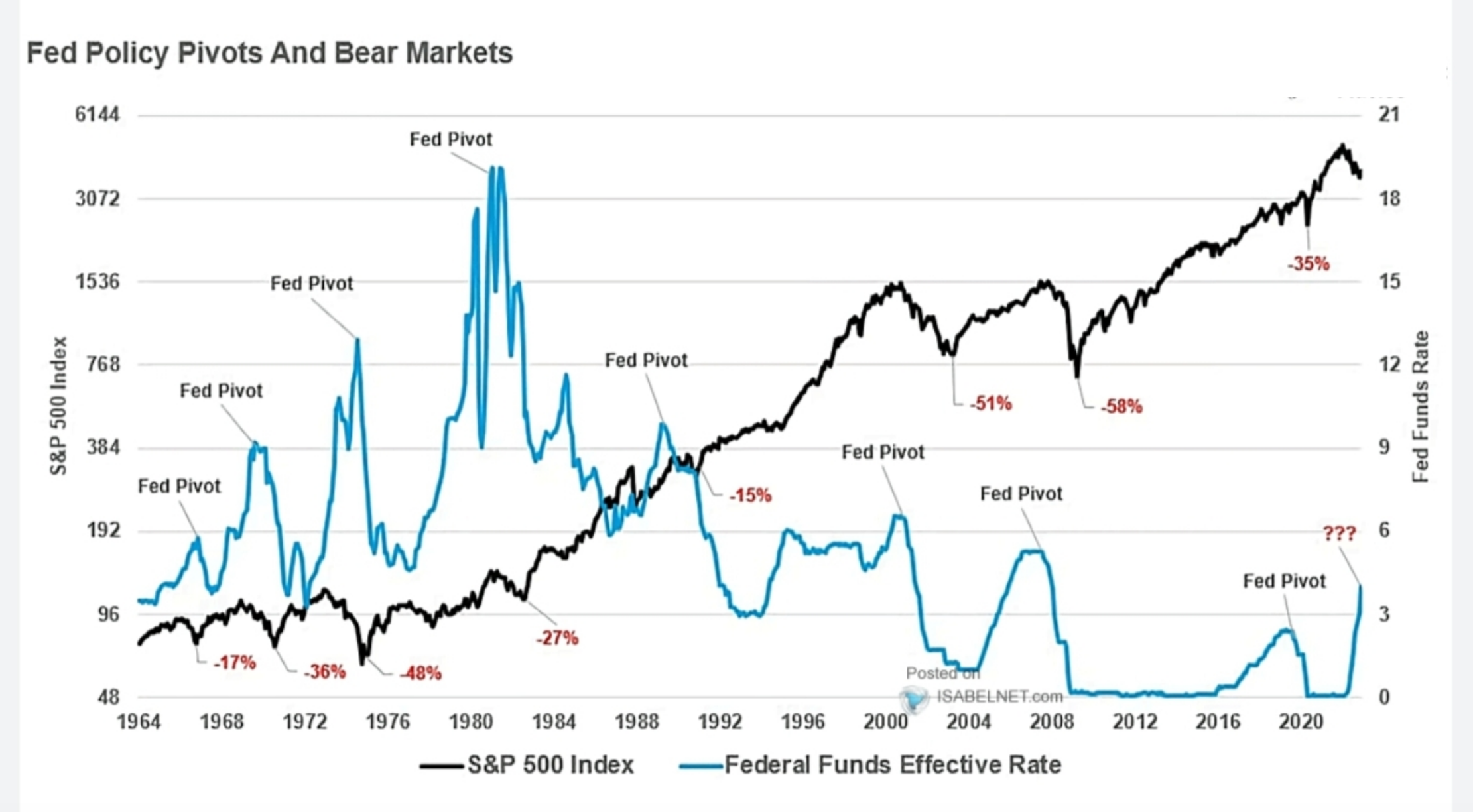

This graph demonstrates SNP500 going down when FED raising rates and going up when FED Pivots and lowers RATES and keeps them colose to 0% ->

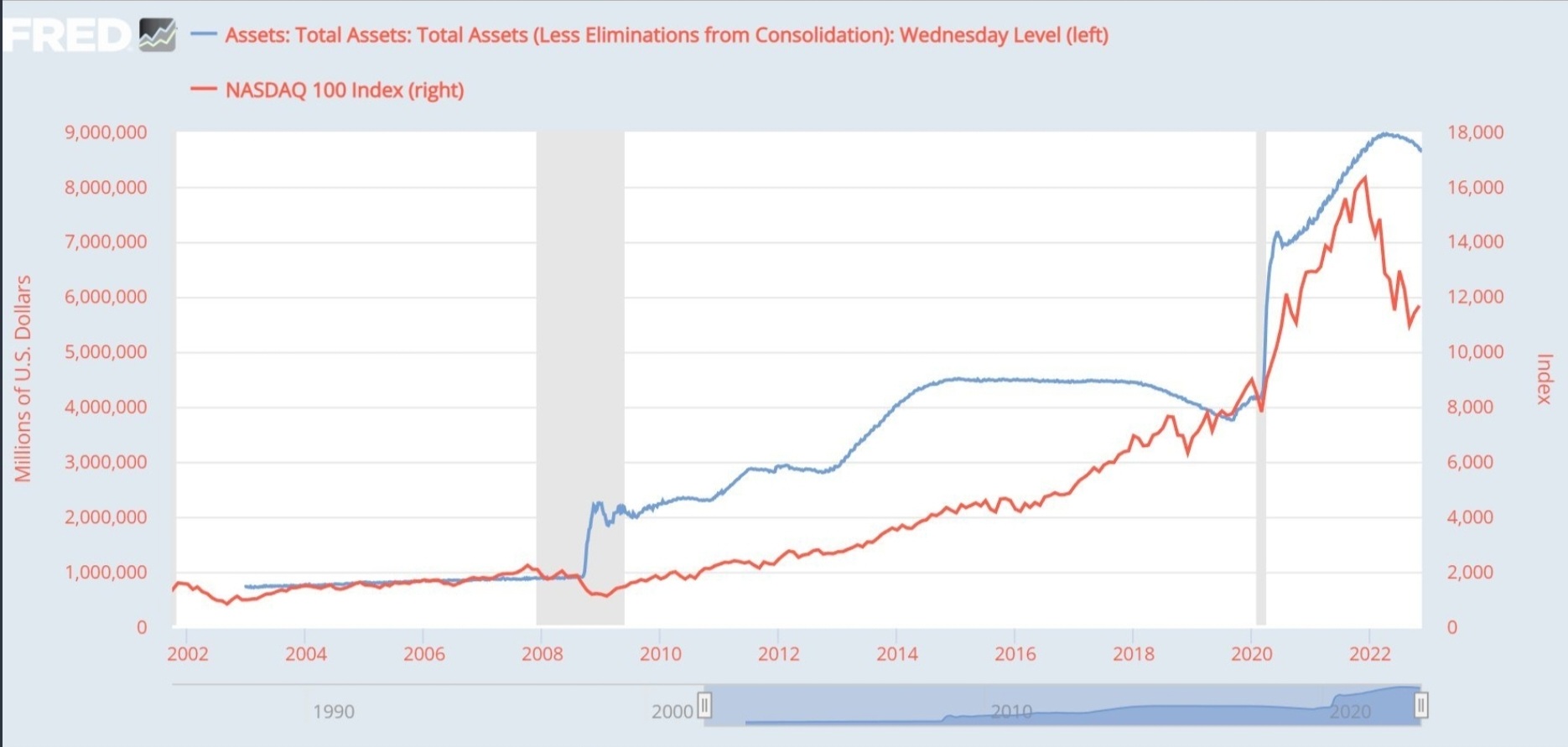

This graph demonstrates NASDAQ100 going up when FED prints TRILLIONS in QE ->

The only real reason for FED to keep Rates low and keep printing TRILLIONS in QE is to keep Stock Market and Housing BUBBLES, created by TRILLIONS in QE, from popping.

High Inflation was just a byproduct inevitably caused by QE and Low Rates.

This graph demonstrates how Low Rates are causing High Inflation ->

Despite raising Inflation due to QE and low Rates, FED keeps lying about inflation been "TRANSITORY", keeps low Rates and continues printing TRILLIONS to prevent Stock Market from popping.

This image helps to visualize impact of QE on Inflation ->

FED doesn't want to admit that Inflation was of their own making.

Every time FED decreases Rates or doing QE, it leads to non organic growth of the US Economy causing Stock Market and Housing BUBBLES and resulting in Higher Inflation.

The longer FED keeps the Rates at the low levels and "PRINTS" Money/QE the bigger Stock Market and Housing BUBBLES have been inflated resulting in higher Inflation.

The bigger the BUBBLES the louder they burst and more damaging RECESSON to follow.

We all know the harm caused by last 2 bubbles: "DOT-COM Bubble" of year 2000 and "Housing Bubble" of 2008.

As for the current BUBBLE, people have already come up with the name: "Everything Bubble".

Many call it "FAANG Bubble" since most of the Stock Market Capitalization is coming from 5 significantly overvalued companies: Facebook(META), Apple, Amazon, Netflix and Google.

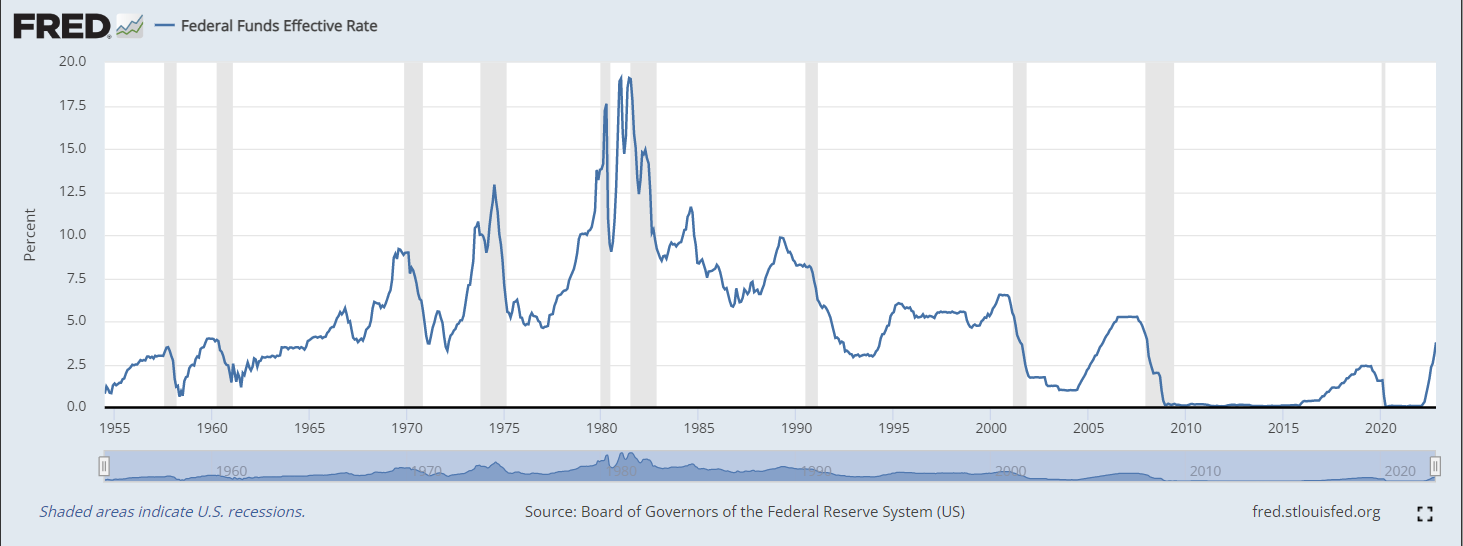

FED was keeping RATES at almost 0% from the 2008 Stock Market Crush till 2015 - FED Rates Increase / Decrease

The next question we should probably ask is why does the FED lower the Rates after each BUBBLE burst?

The answer is:

To keep Recessions from turning into

Great Depressions!!!

On this graph you can see FED FUND Rates since 1955. Gray stripes represent Recessions.

You can clearly see that every single time FED raises RATES, it results in RECESSION to follow.

#2. Second important indicator of upcoming RECESSION is

The Spread between 10 and 2 year Treasury Yields

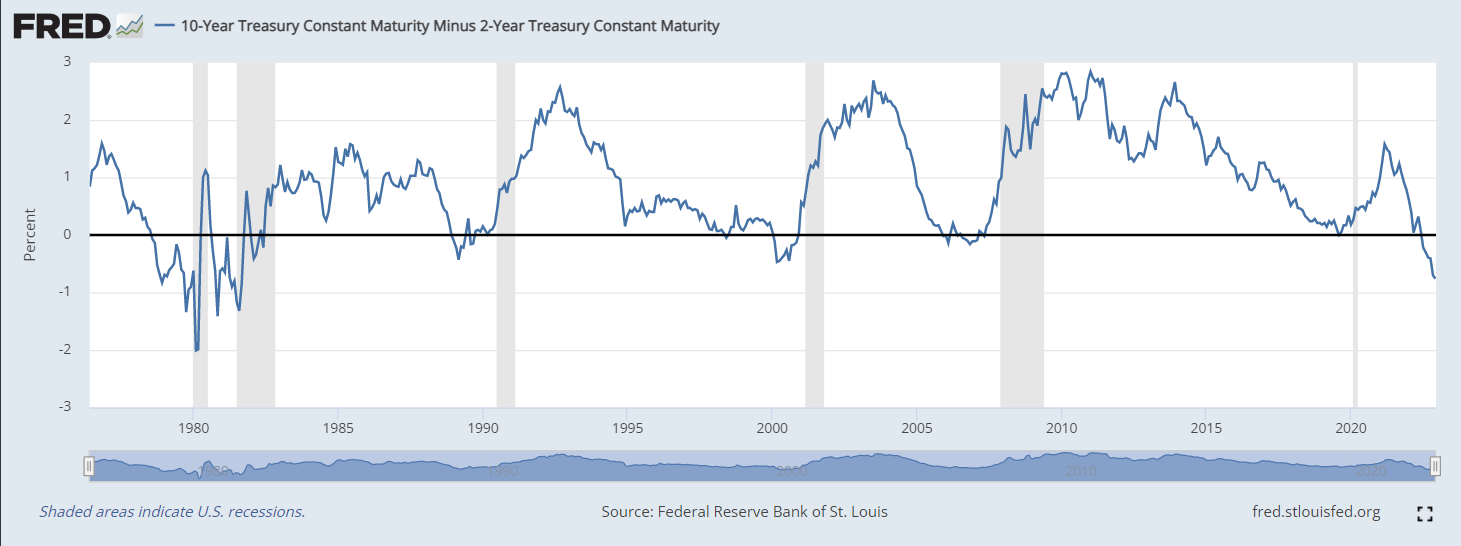

Most famously known as "Inverted Yield Curve" which preceded every single RECESSION in the past.

Historically, Yield curve inverts when 10 year Treasury Yield is smaller than 2 year Treasury Yield.

Yield inversion preceded all previous RECESSIONS!

This graph clearly demonstrates that every Yield Curve inversion (below zerro line) followed by RECESSION (gray stripes).

Currently Yield Curve Inversion is much more severe than inversions preceded 2000 and 2008 RECESSIONS, meaning that upcoming RECESSION will be more severe as well.

#3. Third important indicator of upcoming RECESSION is

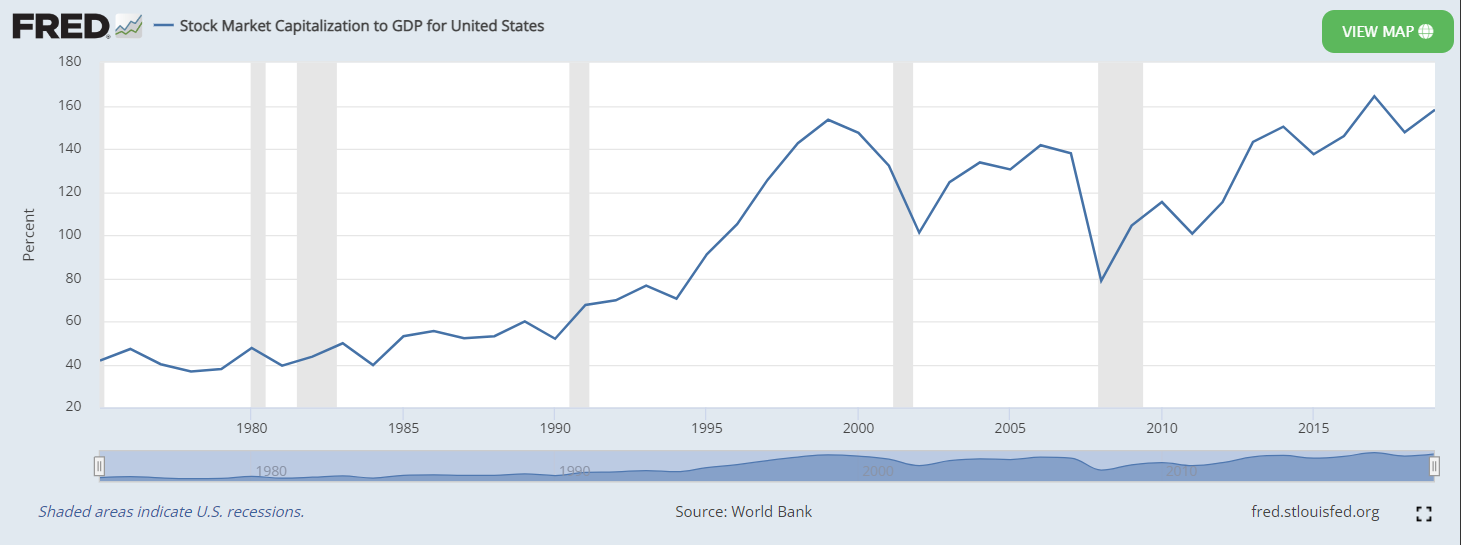

The ratio of Stock Market Capitalization to GDP

GDP - Gross Domestic Product measures the value of economic activity within a country.

GDP is the sum of the market values, or prices, of all final goods and services produced in an economy during a period of time.

Stock Market Capitalization is the total value or the sum of all publicly traded stocks in the US.

Logically thinking the value of economic activity should be somewhat bigger than the sum of all publicly traded stocks, considering that some companies are private.

But in current reality Stock Market Capitalization is over 15 TRILLION US Dollars bigger than GDP!!!

YES it's not 15 MILLION or 15 BILLION but 15 TRILLION Dollars bigger!!!

The difference is $15,000,000,000,000 !!!

On October 2022 the Stock Market Capitalization was about 40 TRILLION US Dollars and GDP was about 25 TRILLION US Dollars.

What this means is that US Stock Market or the SUM of all US Stocks are overpriced by 15 TRILLION dollars!!!

In other words, if you are buying stocks in 2022 you are overpaying about 33 cents on each dollar.

The same happened in the past before each recession. Do you remember the DOT-COM Bubble Crash of 2000 or Housing Bubble Crush of 2008?

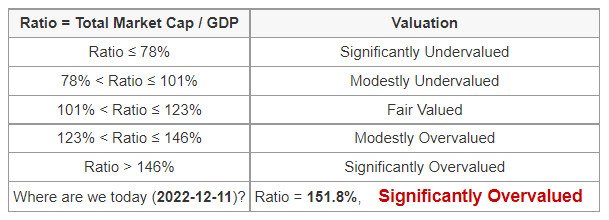

This graph shows impact of low FED Rates and TRILLIONS in QE to non organic growth of Stock Market Capitalization.

Values exceeding 90% corespond to Significantly Overvalued Stock Market - Market BUBBLES!

You can clearly see how "Everything Bubble" has been growing overtime since 2008 due to unlimited QE and low RATES.

Follow this -> Gurufocus link explaining TMC to GDP Ratio in more details:

We hope the information we provided is sufficient to wake up your curiosity and motivate you to do your own research.

The way you can benefit from the upcoming Recession.

We hope you already moved your investments to cash. If not, cross your fingers and hope for another dead cat jump before it gets really ugly...

To benefit from upcoming Recession you need to have cash to invest when Stock Market becomes "Fair Valued" or "Undervalued". While waiting for the Stock Market to reach "Fair Valued" level, educate yourself about Value Investing Theory defined by Ben Graham and proven by Warren Buffett.

Once you are familiar with basic concepts of Value Investing you need to identify the portfolio of stocks you are interested in.

If you don't have an idea about what stocks would have competitive advantage in the future, try to follow investment gurus, you trust.

Research and analyze your stocks, calculate the intrinsic value and wait until your stocks are priced close enough to Intrinsic Value before you make a buy decision.

Use our Intrinsic Value Calculator available on Google Play, Apple App Store and Amazon.

Read "Intrinsic Value Calculator" article to find out more.

Good Luck and Happy Hunting!

![]()

© 2024 Best Implementer LLC

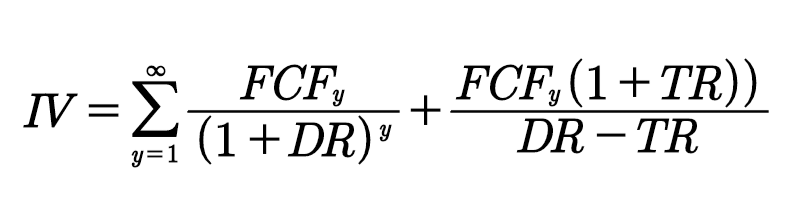

DCF (Discounted Cash Flow) Model is used to estimate intrinsic value of the company based on Future Cash Flows (FCF).

In DCF Model, FCFs are calculated based on a cash flow Growth Rate (GR) and then based on a Discount Rate (DR),

discounted to its current value at the Discount Rate.

All of the discounted FCFs are added together to get the current Intrinsic Value (IV) of the company.

IV of the company can be divided by number of shares to get intrinsic value of each share.

For Growth Rate (GR) we recommend to use 5 or 10 year Average Annual Growth Rate (AAGR).

AAGR can handle majority of cases including negative GR where average results in a positive number.

Simplified explanation of Discount Rate (DR) is an expected rate of return on your investment.

Assume you deposited $100 to you savings account that yields 5% a year.

A year from now you will have $105 on your account.

Meaning $100 represents today's Present Value of your Future Cash Flow of $105 a year from now.

Similarly a future cash flow of $100 a year from now would translate to a Present Value of $95.

Formula representing Intrinsic Value (IV) calculated based on DCF Model:

The above formula consist of 2 parts:

Sum of Present Values for 5 or 10 years of FCFs and Terminal (Perpetual) Value.

Don't get intimidated by this formula, we will explain each parameter in more details.

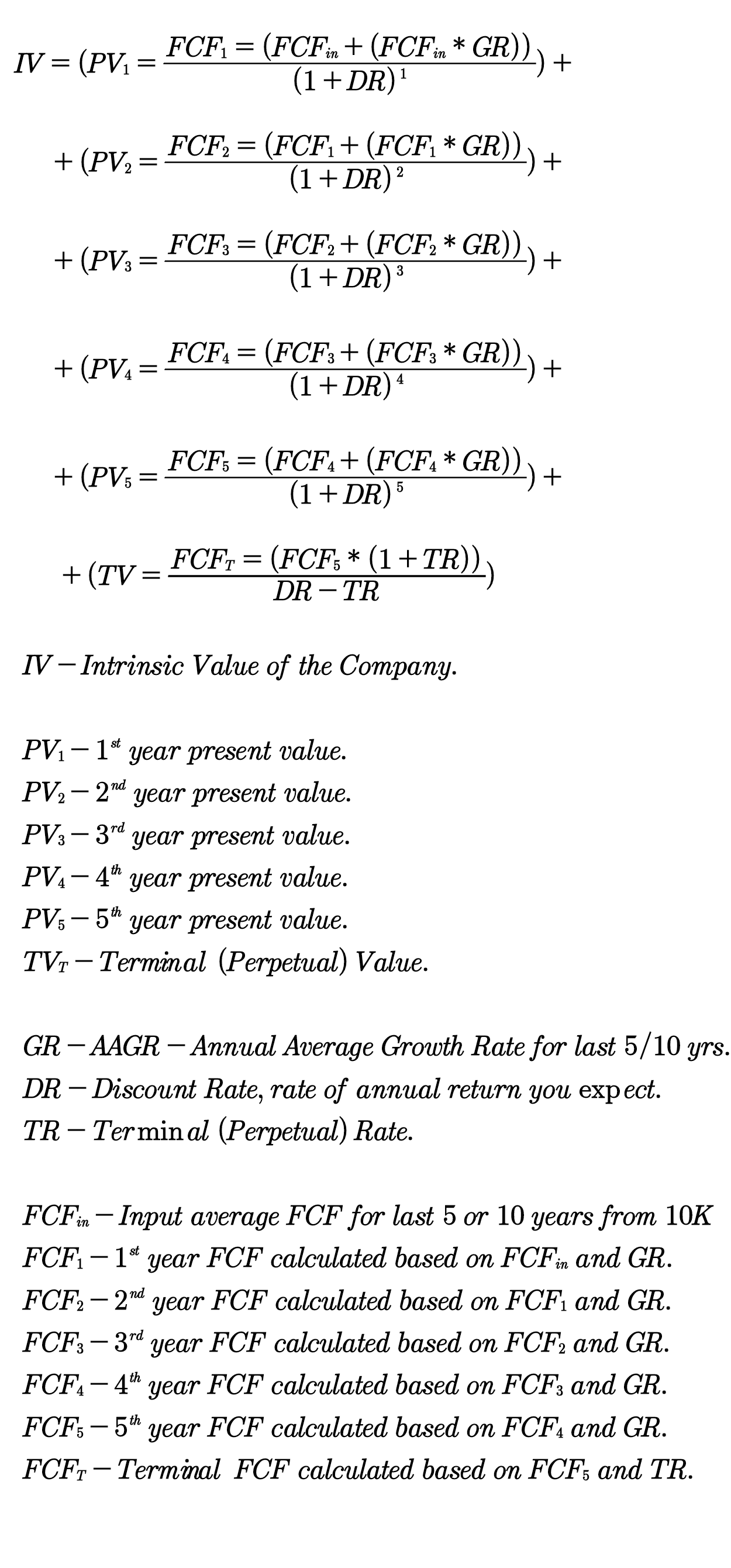

Formula below illustrates calculation of IV based on 5 years FCFs in more details.

You can see that FCF(1) for the first future year is calculated using FCF(in) - average of FCFs for the last 5 years and Average Annual Growth Rate (GR). Next FCF(1) is discounted by Discount Rate (DR) to get Present Value for the first future year PV(1). Same calculation is done for FCF(2), FCF(3), FCF(4) and FCF(5).

Terminal (Perpetual) Value (TV) represents value of the company with assumption that it will generate growth forever (perpetually). The rate used in calculation of Terminal Value is called Terminal Rate (TR) and usually TR is equal to average long term inflation rate, since even best companies usually do not perform better than inflation rate considering extremely long time horizon.

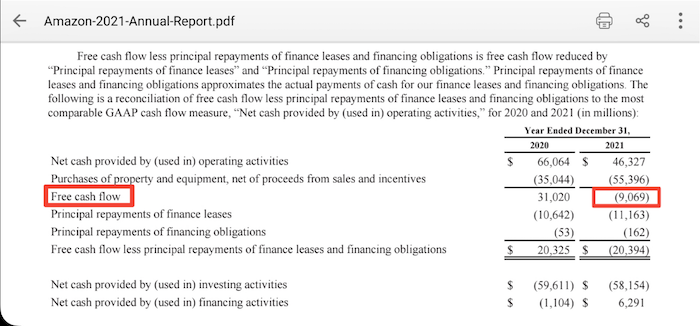

Free Cash Flow can be found on company's annual report - form 10-K.

In case of negative FCF (Free Cash Flow), you need to calculate average cash flow using annual FCFs for the duration you chose, 5 or 10 years.

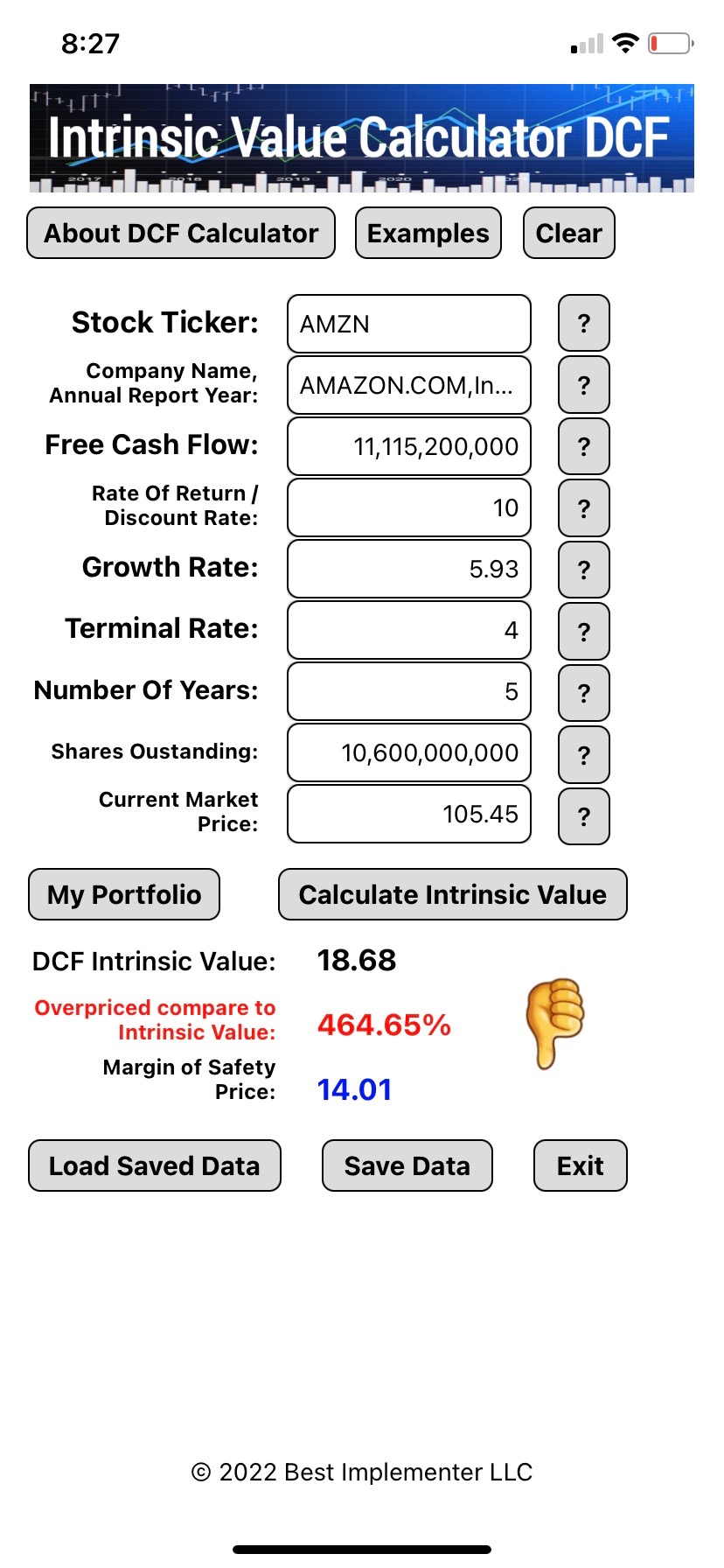

AMZN example:

Amazon has negative FCF since March 2021.

Amazon Annual FCFs (in Millions $) for the last 10 years:

2022 -11,600.00

2021 -9,069.00

2020 31,020.00

2019 25,825.00

2018 19,400.00

2017 8,307.00

2016 10,466.00

2015 7,450.00

2014 1,949.00

2013 2,031.00

2012 395.00

AMZN 5 year average FCF is $11,115,200,000

and 10 year average FCF is $8,577,900,000

With:

Discount Rate = 10%

Growth Rate = 5.93% - AAGR for last 5 years

Terminal Rate = 5%

Shares Outstanding = 10,600,000,000

10 Year DCF Intrinsic Value will be $27.23

5 Year DCF Intrinsic Value will be $18.68

Check this Amazon Example:

Intrinsic Value Calculator DCF is available on AppStore:

Privacy policy:

No personal user data is accessed, collected or shared by this application.

Value Investing - Warren Buffett Strategy

Our mission is to help people not to lose money in the Most Overvalued Stock Market Bubble.

"Though markets are generally rational, they occasionally do crazy things. Seizing the opportunities then offered does not require great intelligence, a degree in economics or a familiarity with Wall Street jargon such as alpha and beta. What investors need instead is an ability to both disregard mob fears or enthusiasms and to focus on a few simple fundamentals." -Warren Buffett

We often make investing harder than it needs to be. Warren Buffett follows a simple approach based on common sense. Everyone can certainly follow his investing tips. That doesn’t mean they are always easy to follow (and some are harder than the others) but persistence and knowledge expansion really goes a long way.

We can study long term value investing by following the Warren Buffett strategy. He has proven to be a disciplined follower of value principles for building wealth. By using his strategies we will definitely improve and sharpen our investment management skills.

Per Warren Buffett’s Value Investment Theory the buy decision should be based on several factors and value investor should have a list of questions to go thru while considering any stocks. Questions are not too complicated and it’s a great way to get introduced to some important concepts. To get answers to these questions, all that is needed is access to the company’s balance sheets and financial statements. You can find this information on the company website, or there is a host of resources such as Google Finance or Yahoo Finance.

- Do you understand the product or service offered by the company? (Make sure company is in your “circle of competence” and do not buy company you don’t understand!)

- Do you think people still be using company’s product or service in 10-15 years from now?

- Does the company have a low cost durable (lasting) competitive advantage?

- Is the company recession proof?

- Has the company had consistent earnings growth? (Generally EPS growth have to be over 7%)

- Has the company had consistent dividend growth? (Generally dividend growth have to be at least 7%)

- Does the company have low payout ratio? (We are looking for payout ratio 75% or less)

- Does the company have low debt? (Debt should be 70% or less)

- Does the company have a good credit rating? (must have minimum S&P credit rating of “BBB+)

- Is the stock undervalued?

- Company’s P/E Ratio must be below 15. The lower the better!

- Company’s current market price should be 20-30% less than calculated intrinsic value – “margin of safety price”.

Calculating and understanding intrinsic value of the stock is one of the most important steps in value investing but it doesn’t take a genius to do it.

“Intrinsic value can be defined simply: It is the discounted value of the cash that can be taken out of a business during its remaining life.” -Warren Buffett

The key is it to calculate the intrinsic value of a business correctly. If you are going to spend some money buying something or making an investment, you wouldn’t want to pay more than it worth. We don’t want to overpay. The tricky question is how to determine the real value of things? Because one thing is the price and other is the value.

There are few different approaches to calculate intrinsic value. Each approach has its own advantages and disadvantages. Even Warren Buffett and Charlie Munger use different models to calculate intrinsic value.

For example, one way to calculate the intrinsic value is to use calculator based on Warren Buffett’s “Ten Cap Price” otherwise known as “Owner Earnings” calculation. After all, what could be more important than earnings, right? Warren Buffett calls Owner Earnings is one of the “most relevant item for valuation purposes – both for investors in buying stocks and for managers buying entire businesses.”

To calculate intrinsic value based on “Owner Earnings” we need several values. All those values found on company’s Annual Report.

- Net Income

- Depreciation and Amortization

- Net Change Accounts Receivable

- Maintenance Capital Expenditure

- Income Tax

Multiply result by 10 and divide by number of shares (you will get intrinsic value per share).

The logical question you would ask, is it possible for a good company to have the market price drop 20-30% bellow intrinsic value? The answer is: YES, it is possible due to various reasons. Those reasons are temporary and could include: bad news about the company, company's industry is out of market favor, market is in correction or recession...

YES, Recession!

All statistical data show that we are in the Market Bubble similar to "DOT-COM Bubble" of 2000 and "Housing Bubble" of 2008.

This Stock Market Bubble is in a process of popping due to FED's QT (QuantitativeTightening - raising interest rates and reducing balance sheet).

QT is a process of removing liquidity and making it harder to borrow a new one, negatively effecting Stock Market and making stock prices go down.

FED is using "fighting" high Inflation as an excuse for doing QT.

In reality FED was the one who caused high inflation by overdoing TRILLIONS in QE (Quantitative Easing) using "full employment" as an excuse.

Stock prices going down due to QT will present an opportunity for Value Investors to buy their favorite stocks for less than Intrinsic Value!

You can read about upcoming Recession and the opportunity it presents here:

Recession of 2023 and The Opportunity For Value Investors

In order to buy your favorite stocks for less than intrinsic value you need to be prepared. You need to know what this intrinsic value is and how to calculate it. Do your homework now! Prepare yourself for new opportunities! Be patient and keep emotions out of investing! Invest only in companies you thoroughly research and understand. The stock market will experience swings but in good times and bad stay focused on your goals. Raw intelligence is arguably one of the least predictive factors of investment success. Buffett believes the most important quality for an investor is temperament.

“You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with the 130 IQ.” – Warren Buffett

![]()

© 2022 Best Implementer LLC